Gst rate on gold making charges sales

Gst rate on gold making charges sales, GST on Jewellery Business Goyal Mangal Company sales

$0 today, followed by 3 monthly payments of $12.00, interest free. Read More

Gst rate on gold making charges sales

GST on Jewellery Business Goyal Mangal Company

What Is The Rate Of GST On Gold In India DigiGold

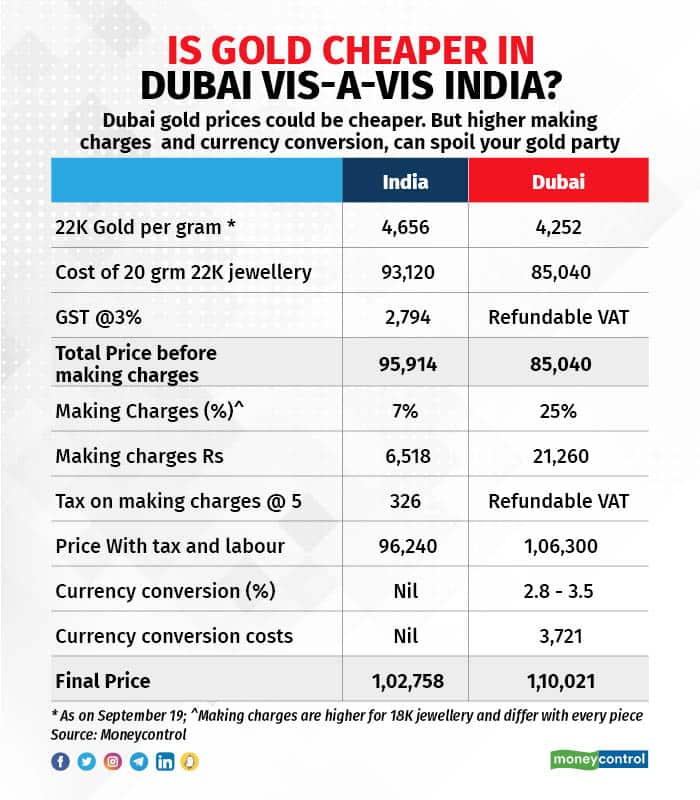

Buying gold from Dubai to avoid import duty Think again

In India the Goods and Services Tax GST rate for gold is 3 However for making charges the GST rate is 5 But gold jewellery is considered a composite supply of goods and services the overall

Impact of GST on Gold And Gold Jewellery Prices Buy Now or Later

Are Jewellers fooling you In the case of gold Jewellery both the Jewellery and making charges are chargeable at a 3 GST rate as they are a composite supply. gold gold jewellery goods and

conkhoemevui.vn

Product Name: Gst rate on gold making charges salesGST Registration Effects of Gold GST Rate in India 2024 E Startup India sales, GST Impact On Gold Impact of GST on gold and gold jewellery prices Times of India sales, Gst percentage of deals gold sales, Gold GST Rate GST sales, GST on Gold Effects of Gold GST Rate in India 2024 sales, GST on Gold Effects of Gold GST Rate in India 2024 sales, GST On Gold in India in 2024 GST Rates on Gold Jewellery Purchases sales, Gold GST Rate GST YouTube sales, GST On Gold In 2022 Check Tax Rates HSN Codes Here sales, GST on Gold Effects of Gold GST Rate in India 2023 Corpseed sales, GST on Gold Jewellery Making Charges 2022 Bizindigo sales, GST on Gold GST Impact on Gold Making Charges GST Paisabazaar sales, Gold GST Rate Archives BIZINDIGO sales, Gold Jewellery HSN Code GST Rates for Gold IndiaFilings sales, GST on Gold Jewellery Goyal Mangal Company sales, GST on Gold coins making charges HSN code GST PORTAL INDIA sales, GST rate on gold and making charges sales, GST Gold Calculator APK for Android Download sales, bemoneyaware on X Price of the gold ornament is Price of 22K gold Weight in Grams Wastage charges Making Charges GST at 3 Differences sales, Save Immediately Gold Jewellery Fraud In India the Goods and Services Tax GST rate for gold is 3 However for making charges the GST rate is 5 But gold jewelry is considered a sales, GST on Gold Jewellery Gold Jewellery GST GST on Making Charges of Gold Jewellery sales, GST rate on jewellery making charges cut to 5 from 18 stocks jump up to 3 Industry News The Financial Express sales, GST Registration Effects of Gold GST Rate in India 2024 E Startup India sales, The GST on gold ornaments is 3 of the total value of the gold jewellery. This includes both the value of the gold and any making charges. This rate is charged as a total of CGST and SGST which is sales, What is the Impact of GST on Gold in India GIVA Jewellery sales, GST Council cuts tax rate on gold jewellery making charges to 5 BusinessToday sales, GST on Gold How the Gold GST Rate Affects Gold Industry in India sales, GST on Jewellery Business Goyal Mangal Company sales, What Is The Rate Of GST On Gold In India DigiGold sales, Buying gold from Dubai to avoid import duty Think again sales, In India the Goods and Services Tax GST rate for gold is 3 However for making charges the GST rate is 5 But gold jewellery is considered a composite supply of goods and services the overall sales, Impact of GST on Gold And Gold Jewellery Prices Buy Now or Later sales, Are Jewellers fooling you In the case of gold Jewellery both the Jewellery and making charges are chargeable at a 3 GST rate as they are a composite supply. gold gold jewellery goods and sales, How Much GST is Applied to Gold Jewellery in India The Caratlane sales, What Is The Rate Of GST On Gold In India DigiGold sales.

-

Next Day Delivery by DPD

Find out more

Order by 9pm (excludes Public holidays)

$11.99

-

Express Delivery - 48 Hours

Find out more

Order by 9pm (excludes Public holidays)

$9.99

-

Standard Delivery $6.99 Find out more

Delivered within 3 - 7 days (excludes Public holidays).

-

Store Delivery $6.99 Find out more

Delivered to your chosen store within 3-7 days

Spend over $400 (excluding delivery charge) to get a $20 voucher to spend in-store -

International Delivery Find out more

International Delivery is available for this product. The cost and delivery time depend on the country.

You can now return your online order in a few easy steps. Select your preferred tracked returns service. We have print at home, paperless and collection options available.

You have 28 days to return your order from the date it’s delivered. Exclusions apply.

View our full Returns and Exchanges information.

Our extended Christmas returns policy runs from 28th October until 5th January 2025, all items purchased online during this time can be returned for a full refund.

Find similar items here:

Gst rate on gold making charges sales

- gst rate on gold making charges

- gst rate on gold ornaments

- gst rate on gold jewelry

- gst rate on jewellery making charges

- gst rate on making charges of gold jewellery

- gst rate on silver

- gst rate on silver coins

- gst rates on jewellery

- gst rate on silver ornaments

- gst s100